Video: One week left to sign up for free Pre-k and 3-k!.

Description will be added later.

My patterns

Drag and drop patterns into the canvas.

Video: One week left to sign up for free Pre-k and 3-k!.

Description will be added later.

Drag and drop patterns into the canvas.

During the press conference, Mayor Mamdani addressed several key issues concerning NYC residents.

The following questions were asked to Mayor Mamdani, and he provided these answers:

Sources: NYC video

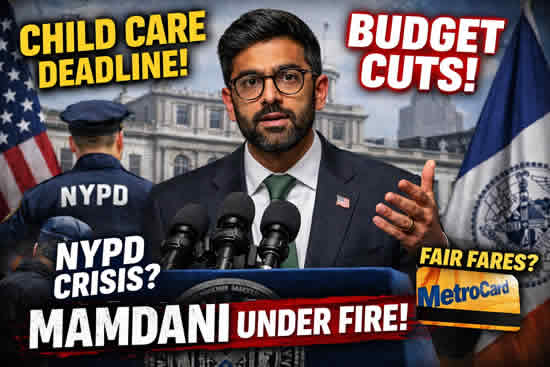

Video: Mayor Mamdani Holds Press Conference to Make a Child Care Announcement.

Description will be added later.

Drag and drop patterns into the canvas.

Video: This is how NYC is celebrating Lunar New Year.

Description will be added later.

Drag and drop patterns into the canvas.

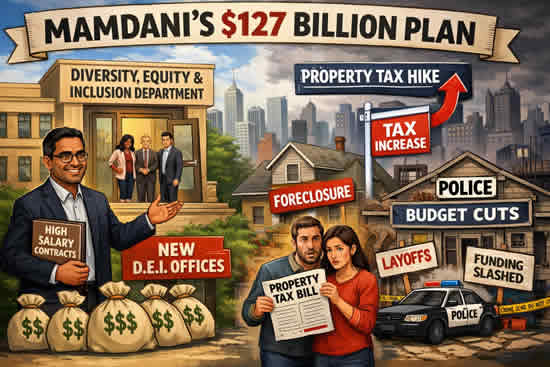

Yes — the city’s own press release confirms the $127 billion FY27 preliminary budget and the 9.5% property‑tax scenario, and it links that to Mamdani’s plan. The official budget announcement (NYC.gov, Feb 17 2026) states:

That same official document frames the choice as “raise revenue from the wealthiest… or balance the budget on the backs of working and middle class New Yorkers,” and it notes the administration is funding selected new investments while closing a $5.4 billion gap.

The official release doesn’t itemize every equity office, but media analysis of the released budget materials reports the specific allocations that support the claim:

So the official site proves the $127 B budget and the property‑tax hike mechanism; budget detail reporting based on the city’s materials provides the proof for the diversity‑office funding, six‑figure roles, and NYPD staffing change.

Sources: nyc.gov , Midtown Tribune News

Video: Ramadan Mubarak.

Description will be added later.

Drag and drop patterns into the canvas.

Video: Mayor Mamdani Holds Press Conference to Break Ground on Timbale Terrace.

Description will be added later.

Drag and drop patterns into the canvas.

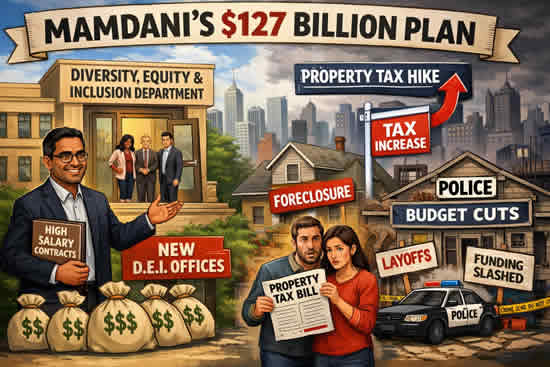

Mayor Mamdani delivered the Fiscal Year 2027 Preliminary Budget (1:41) on February 17, 2026, from City Hall in Manhattan, New York. The presentation detailed the city’s financial challenges and proposed solutions.

Addressing the Inherited Budget Crisis (1:41-2:27): The administration inherited a historic budget gap (2:06), initially projected at $12 billion (2:23) by the previous Mayor Adams’ administration, which had significantly understated the deficits (5:11). The Mayor stated that this deficit was primarily due to the underbudgeting of key areas (6:34):

Strategies to Reduce the Deficit (2:09-11:00): The administration implemented several aggressive measures to lower the deficit from $12 billion to $5.4 billion (2:23):

Two Paths to Bridge the Gap (2:47-4:02, 11:03-11:34): The Mayor outlined two distinct paths for bridging the remaining $5.4 billion deficit:

Preliminary Budget Details and Investments (13:31-16:45): The preliminary budget is balanced at $122 billion in fiscal year 2026 and $127 billion in fiscal year 2027 (13:40).

Commitment to Affordability Agenda (52:20-53:44): Despite the fiscal crisis, the Mayor reiterated commitment to key campaign promises:

The Mayor emphasized that the preliminary budget reflects the second path out of necessity, but the administration will work to ensure the final budget reflects the first path of taxing the wealthy and ending the drain on the city (17:05).

City Hall, Blue Room Manhattan, NY

February 17, 2026

Five DOS programs, one mission: making sure New Yorkers know about the resources available to them. From the Office for New Americans, Consumer Protection, Faith to our Cultural Commissions, our DOS programs showed up at Caucus weekend to support community voices across the state.

The New York State Department of State (DOS) shared a message highlighting five DOS programs that engaged with communities during Caucus weekend to raise awareness of state resources. This appeared on the agency’s social media platforms (e.g., Instagram and Facebook) and emphasizes outreach efforts by multiple DOS divisions aimed at connecting New Yorkers with critical services.

While the exact five programs aren’t listed in the social post itself, the departments referenced generally include the following DOS divisions that routinely conduct outreach and resource promotion:

The DOS outreach at Caucus weekend was meant to:

The initiative reflects an active push by the Department of State to make government services more visible, accessible, and understandable — especially for immigrants, low-income consumers, nonprofit partners, and culturally diverse communities throughout New York

Sources: New York Department of State New York State Office for New Americans and NYS Department of State Division of Consumer Protection ,

Video: Mayor Mamdani Presents Fiscal Year 2027 Preliminary Budget.

Description will be added later.

Drag and drop patterns into the canvas.